Every successful marketing effort starts with a solid strategy. It’s how you show your value to potential clients.

Financial advisors have a big impact on people’s lives, offering advice on everything from investing to taxes and insurance.

That’s why it’s so important to communicate the real benefits of your services in a way that connects with your audience.

But with so much competition out there, what are some strategies you can really rely on?

- How to market yourself as a financial advisor

- 9 Most effective financial advisor marketing strategies for lead generation

- 1. Leverage PPC lead ads

- 2. Share content on LinkedIn

- 3. Feature an FAQ on your website

- 4. Have a clear “About Us” section

- 5. Establish a referral program

- 6. Network with other professionals

- 7. Financial advisor event marketing with LinkedIn Promotion

- 8. Financial advisor Facebook marketing for staying visible

- Top 3 marketing tips for financial advisors

- How to build a financial advisor marketing plan

- Final Thoughts

In this article, you will discover the most effective financial advisor marketing strategies that you can easily implement to attract qualified clients.

In addition, there are tips about other key components and automation tools to include in your marketing plan, such as:

How to market yourself as a financial advisor

You want to start before generating your first lead as a financial advisor. Think about how you approach a new client. You don’t lead with a sales pitch. Instead, you start with a conversation.

You ask about their goals, their challenges, and where they see themselves in the future. Then you build a plan that fits. This is sales 101 for you.

Marketing yourself works the same way. It’s not about pushing services. It’s about showing the right people who you are, how you help, and why they should trust you.

Here’s how we guide financial advisors to build a more effective marketing mindset so you can build strategies that actually work later on.

- Nail your digital first impression

Your website and LinkedIn profile are often the first touchpoints. Make sure they’re serving you well.

Keep your outward image of yourself and your business transparent. Your message should be simple, clear, and client-focused. For instance, talk less about what you do and more about how you help.

Also, use local keywords to show up in search results (“financial advisor in Dallas,” for example), and make it easy for people to contact you.

- Use social media with purpose

You don’t need to post every day, but when you do, make it count. Share insights that are actually useful, and post quick tips or short videos that explain complex ideas in plain English.

Be consistent. And always include a call to action, like “message me with questions” or “join my newsletter” to build an audience you can market to down the line.

- Educate to build trust

Workshops and webinars let you show your expertise without sounding like a pitch. And not focusing on conversions at all. Pick topics your ideal clients care about. It could be tax planning, saving for college, or retiring early.

Also, make sure that you are offering clear, actionable advice. People recognize who helped them, not who tried to sell to them, in a sneaky way.

Another high-trust topic is taxes. Consider offering a concise, jargon-free guide that explains deductions, quarterly estimates, and year-end timing so clients can optimize their tax strategy while seeing how tax planning supports retirement and cash-flow goals. Pair it with a short webinar and a printable checklist, then invite questions to start advisor–client conversations.

- Focus on one audience

Trying to talk to everyone makes it hard to connect with anyone. Choose a niche you know and enjoy, like business owners, teachers, or people nearing retirement, and create content and messaging just for them. It makes your marketing clearer, more targeted, and more effective.

- Stay top of mind with simple content

Email newsletters, short blog posts, or even a quick video series can help keep you on your audience’s radar. Focus on real info like current market trends, common money mistakes, or questions you hear often. Don’t overthink it. Just be helpful and human.

- Build a brand around who you really are

Do you want to be just another advisor? Maybe you’re the one who makes financial planning less intimidating. Perhaps you’re known for helping small business owners retire early.

However it is that you want to project your image, lean into it. Your brand is the story people remember about you, so make sure it’s honest.

9 Most effective financial advisor marketing strategies for lead generation

Specific lead generation practices for financial advisors should be implemented to acquire the most suitable prospects for your business.

These informed approaches should be successful in prompting leads to interact with your business and take a step closer to availing of your services.

Let’s take a look at the nine most effective financial advisor marketing strategies that can be readily integrated into your existing marketing campaigns.

1. Leverage PPC lead ads

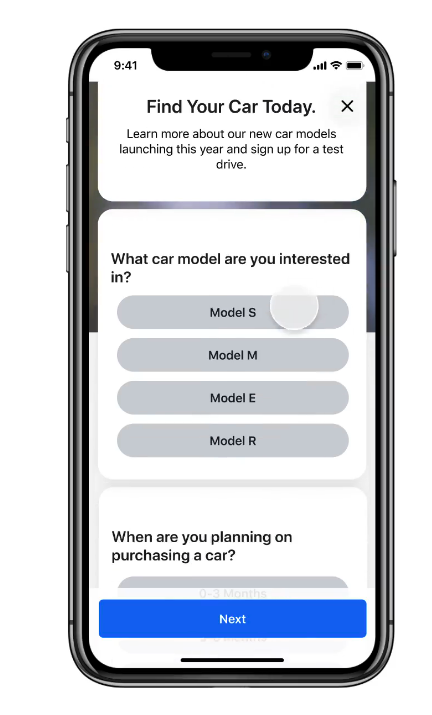

Lead generation through PPC (pay-per-click) allows you to acquire leads through highly-targeted advertising in a low-pressure and cost-effective manner.

PPC advertising lets you attract prospects who are looking for exactly what your business offers. It can be carried out on both desktop and mobile formats.

After all, paid search advertising offers an average conversion rate of 5.10% within the financial industry. This makes it the second most impactful channel for generating leads, right after organic search and SEO.

PPC ads are a great way for leads to learn more about your business and build trust. With automation tools like LeadsBridge, you can turn that first click into a real connection by sending targeted messages that keep them interested.

When it comes to different platforms and options, the best practices for lead generation for financial advisors through ads are:

Lead generation for financial advisors can be performed through advertising, such as Facebook lead ads.

As the original PPC lead ad option, Meta lead ads remain one of the most effective methods for consistently channeling leads into your sales pipeline.

This tool also provides a number of audience targeting options that you can choose from based on your objectives, including custom and lookalike audiences.

LinkedIn is another great option for finding leads, especially among professionally segmented audiences. With LinkedIn Lead Gen Forms, you can reach the right people and narrow your audience by industry or job title to get even better results.

Using LinkedIn Matched Audiences, you can retarget website visitors and promote your advisory services to contacts within your CRM and other marketing management tools.

Learn more about the best CRMs for financial service businesses here.

Google Lead Forms works much like Facebook and LinkedIn lead ads. It helps generate leads via search advertising, allowing you to capture high-intent users looking for specific services.

2. Share content on LinkedIn

LinkedIn is a great place to share helpful content with professionals, showcase your offerings, and highlight what sets you apart from the competition.

LinkedIn is widely viewed as one of the most credible sources of content. Over 100 million people use LinkedIn Groups each month, making them a great place to share case studies, build credibility, and show the real value of what you offer.

Additionally, People who see both brand and sales messages on LinkedIn are 6 times more likely to convert. That’s because combining credibility with social proof like testimonials and case studies really motivates potential clients to take action.

All these make this platform an advantageous tool for building trust within customer relationships.

3. Feature an FAQ on your website

Including a dedicated FAQ (frequently asked questions) page on your website is one of the most commonly overlooked financial advisor marketing strategies.

It can go a long way in helping leads better understand your business and policies. However, it does even more when combined with a flawless website experience.

Websites with excellent user experience, which typically includes clear navigation and helpful resources like FAQ pages, enjoy 400% higher conversion rates compared to those with poor UX.

For instance, you can address common concerns such as tax implications of financial advisory expenses on this page. This can provide valuable insights for potential clients seeking clarity on their financial planning.

Sharing useful info upfront helps shape a positive first impression before someone even becomes a client.

Besides, adding an FAQ section can also boost your visibility in search results by answering common questions people are already asking.

Tools like Semrush offer features for finding question-based keywords, which can help you choose the right ones to include.

Here’s how a financial advisor’s FAQ section might look:

4. Have a clear “About Us” section

Your website is often where potential clients first reach out, so it needs to run smoothly, load fast, and guide visitors easily toward taking action.

Since people at the top of the funnel are still getting to know your business, a strong, clear “About Us” page is key.

It should quickly show who you are, what you stand for, and what sets you apart.

Here’s an example:

5. Establish a referral program

When looking for ways to get more leads, many businesses forget about one of their best assets. We are talking about their existing network and current clients who’ve already said yes.

Referral marketing is one of the most effective ways to generate leads. In financial services, referral marketing brings an average return of 15x. This shows just how valuable and effective referrals can be in this industry.

Adding a referral program to your strategy lets you tap into your network in a cost-effective way and bring in high-quality clients.

A small incentive, like a discount or free consultation, can motivate existing clients to spread the word.

6. Network with other professionals

Networking often happens between you and potential clients, but it can also happen between businesses.

Building relationships with companies like real estate agencies can lead to referrals from clients who need financial advice to get closer to buying a home. These kinds of partnerships build trust and create shared value.

You can take it even further by teaming up with marketing pros to help with cross-promotion and targeted outreach. This added twist can make your networking efforts even more effective.

7. Financial advisor event marketing with LinkedIn Promotion

We already talked about LinkedIn as a networking ground. However, hosting great client events is half the job. Getting people to show up is the other.

One way is to use LinkedIn’s built-in event registration forms. These forms let you capture names, emails, and other key info when someone signs up.

Later, you can use these to run follow-ups or warm outreach. However, to do this efficiently, you want to automate your lead generation.

Additionally, you can promote your event by posting about it a few times leading up to the date, tagging key connections, and sharing behind-the-scenes content or past event photos.

It’s worth sending direct invites to your ideal prospects through LinkedIn messaging. When done right, LinkedIn event marketing fills seats and brings in qualified attendees who are already thinking about their finances.

8. Financial advisor Facebook marketing for staying visible

Facebook may not feel as professional as LinkedIn, but it can be great for connecting with potential clients. You just need to get your audience segmentation aligned with the channel through which you reach them.

Facebook is great for connecting with retirees, families, and small business owners. Create a business page that reflects your brand and post consistently: financial tips, videos, quick polls, or even behind-the-scenes content from your events.

Use Meta ads and boosted posts to target local audiences or niche groups based on age, interests, or financial milestones. To take it a step further, use Meta lead ads integrations via LeadsBridge to automatically pull contact info from interested users straight into your CRM or email list.

9. Employ marketing automation & integrations

One of the best marketing solutions for financial advisors is to fully take advantage of the power of automation and third-party integrations.

Automated data bridges help cut off manual data management and improve your lead nurturing process. Additionally, using accountancy software enables you to manage finances more smoothly alongside your marketing.

LeadsBridge offers a wide range of integrations specifically geared toward the financial industry. However, we also provide a number of ways to leverage financial advisor marketing automation. These include:

- Syncing leads from a number of top advertising platforms to the best CRMs for financial services in real-time

- Automatically transferring new contacts within your CRM to your email marketing software, which can then be added to your newsletter mailing list

- Getting instant notifications by email or messaging apps when a lead fills out a form helps you follow up right away.

Top 3 marketing tips for financial advisors

To ensure that your strategies are having the desired effect on your lead generation, we suggest that you consider the following three marketing tips for financial advisors.

1. Define your target audience

Although this may seem like an obvious first step in the ideation of any strategy or campaign, clearly narrowing down the traits of your target audience can often fall to the wayside when attempting to generate leads.

It is important to remember that quantity is not parallel with quality, and the best generation tactics are futile if not used on potentially qualified prospects. Not every individual will be in need of a financial advisor, or have the ability to pay the fees to avail of the service.

By clarifying your ideal audience and focusing on their specific characteristics, you will gain an understanding of how to communicate with them, implement a functional lead generation strategy and build a powerful database of clients.

2. Identify the pain points of your audience

In the simplest terms, customers typically engage with a business for one of two reasons, these being that the product/service brings them joy or remedies a pain point.

One of the most constructive ways to immediately grasp consumer attention and set yourself apart from your competitors is to directly address the primary pain points of your target market. By taking the time to understand and eliminate the largest obstacles that your prospects experience, you can improve and refine your offering whilst simultaneously strengthening your customer relationships.

For example, you can start by asking yourself, why would a variety of audience segments seek out the services of a financial advisor? What misconceptions do they have about the requirements for financial advisory services?

3. Publish a newsletter

Email has rapidly become one of the most popular channels used to administer marketing communications to new and existing clients, with 69% of marketers using email to distribute content.

Within this rise of email marketing, newsletters have experienced a growth in favor. Newsletters provide businesses the chance to educate their customers, stay connected with leads and cross-sell financial services where appropriate.

As one of the most valuable marketing tips for financial advisors, email newsletters should be a consistent facet of your lead generation strategy. Use this medium to create value for clients, which can be done by segmenting your audiences and content based on demographics and sharing industry specific information and updates.

How to build a financial advisor marketing plan

To curate a successful and lasting financial advisor marketing plan and get more leads in your sales funnel, the following elements should be included:

Define your goals

As with any marketing plan, deciphering a clear set of goals is essential. These objectives will act as a foundation for your strategies, motivator for actions and guideline for the measurement of results.

It is best practice to reference the SMART framework when setting key goals, ensuring that each desired outcome is specific, measurable, achievable, relevant and time-bound.

Whether you are planning to target a younger demographic of investors or add new financial services to your offering, your marketing plan should be reflective of how you visualize the future of your business.

Select your marketing channels

Choosing the most appropriate marketing channels to distribute content is pivotal in ensuring that you reach your intended audience. Not only must you consider which platforms support your content type the best, but also where your target clients hold a presence and how they consume this content.

To gain a better understanding of which channels to use going forward, you should spend time analyzing the social media presence of your competitors, evaluate which content generates high interactions and which opportunities exist for you to elevate your own content, offer more value and differentiate yourself.

Establish a timeline and budget

One of the most essential marketing tips for financial advisors building a marketing plan is to determine an expected timeline and realistic budget. Time and marketing dollars are two of your most precious resources, which makes it vital to implement a well-timed, sufficiently funded strategy that can produce desired outcomes.

As well as this, a defined timeline and budget will act as a guideline for the breadth of your activities, allowing you to stay on track and measure your progress.

Regularly track results

To obtain a true picture of the success of your financial advisor marketing plan, you must frequently and consistently measure your quantitative and qualitative data. By deciding which KPIs (key performance indicators) are most important to track, you can analyze which of your marketing efforts are performing as intended and which ones need to be altered.

Final Thoughts

Marketing within the financial advisor industry is no easy task, and a huge portion of this process centers around demonstrating your value and building trust amongst prospective customers. After all, leads are people and they want to put their financial future in the hands of someone that they can have confidence in.

By introducing the financial advisor marketing strategies discussed above into your future campaigns, you can begin to foster trust amongst your audiences, create strong client relationships and create a database of customers that provide lifetime value to your business.

Ready to scale your financial advisor firm quickly with these marketing strategies? Take a look at our integrations for financial services to get started.